Payment Processing

Credit Card Processing 101

The process that occurs from the time a customer swipes or enters their credit card information to the completion of the purchase is an intricate one. It involves many players and features many stages that help ensure a valid transaction has occurred. On the merchant side, it entails paying fees, reconciling authorizations regularly, and often using an efficient point-of-sale system tailored for their business. Understanding how credit card processing works will help you make smart business decisions that benefit your business’ bottom line, including selecting the best processing platform for your needs.

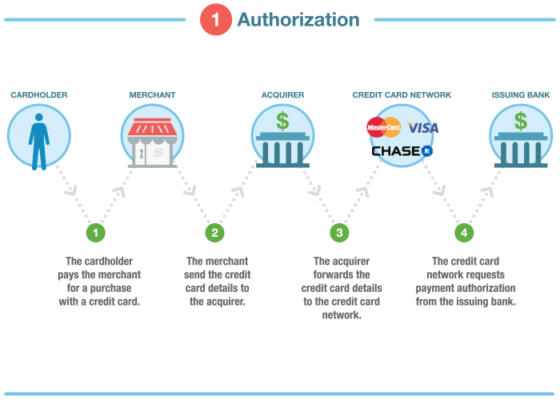

Stage 1: Authorization

Credit card processing has two primary stages: authorization and settlement. Each stage has its own associated fees. To begin to get the lay of the land, it’s helpful to know who the main players are in credit card processing and the role each plays in the authorization stage.

- Cardholder: A card-carrying customer taps, swipes, or inserts a credit card into the payment portal to kick off the transaction.

- Merchant: A store or seller provides the card machine that transmits the cardholder’s information and purchase details to their acquiring bank. The merchant also pays fees charged by the bank or credit card company.

- Acquiring bank: Depending on the level of service provided, the acquiring bank may supply credit card processing equipment and a merchant account. The acquiring bank serves as the information superhighway, routing transaction details through the card network and then to the issuing bank for approval.

- Card network: These are the companies — Visa, Mastercard, American Express (to name a few) — that act as an intermediary, relaying information between the acquiring and issuing banks and establishing fees.

- Issuing bank: Responsible for approving or declining transactions and ultimately paying the acquiring bank, the issuing bank receives the transaction information from the acquiring bank and ensures sufficient cardholder funds.

One the issuing bank has validated the transaction information and determined the cardholder’s account is active, the “transaction approved” message reaches the merchant’s terminal, software, or gateway. All that’s left is settlement.

Stage 2: Settlement

Typically, at the end of each business day, merchants access each credit card authorization from their point-of-sale system, linked to an account at their acquiring bank. They then send a batch of authorizations to their acquiring bank, which reconciles the authorizations and sends the batch to the issuing bank after routing it through the card network.

DCRS offers transparent pricing on point-of-sale platforms, including CoCard, Shift 4, and SpotOn.

DCRS offers transparent pricing on point-of-sale platforms, including CoCard, Shift 4, and SpotOn.

Finally, the acquiring bank deposits money from the merchant’s sales — minus processing fees — into the business account. Acquiring banks typically use daily or monthly discounting to deduct fees from your credit card transactions.

When the acquiring bank deducts fees each day, the net sale amount (after fees) will be deposited in the business’ account. If deducting fees for a month’s worth of transactions, the acquiring bank deposits the gross sale amount (before fees) into the business’ account each day. Acquiring banks may let you choose the method you prefer.